Table of Contents

Small business owners often seek external funds for various needs like bridging financial gaps, buying equipment, or expanding operations.

While those with good credit can easily access affordable loans, securing “business loans for bad credit” is more challenging and usually more costly.

According to the Small Business Credit Survey, 60% of businesses with good credit got full funding approval, and only 19% of those with poor credit succeeded.

Business Loans for Bad Credit and Its Impact

Source: WION

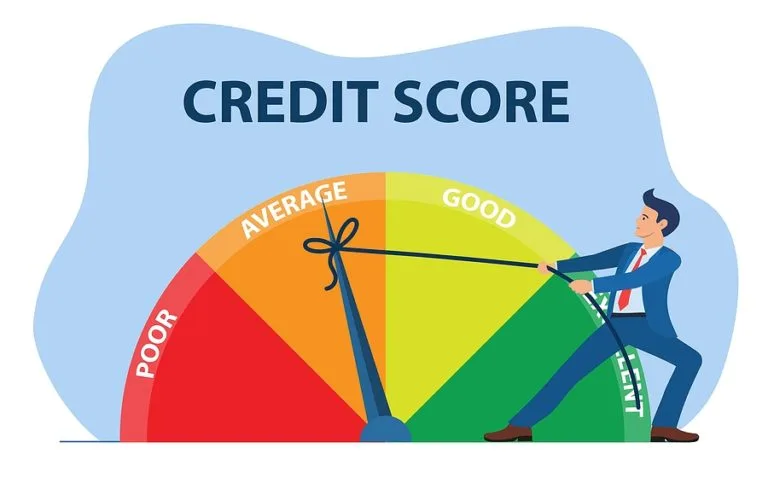

Understanding Credit Scores

Credit scores are important for lenders to assess the risk of lending money. According the HighRadius, they range from 300 to 850, with higher scores indicating lower risk to lenders. A credit score below a certain level, often below 600, is usually classified as ‘bad credit.’

This classification significantly impacts a business owner’s access to traditional financing options. Lenders view lower scores as a signal of a higher risk of default, which can make them hesitant to offer loans.

Read more: Business Risk Factors: Essential Knowledge for Business Owners

The Ripple Effect of Bad Credit

The consequences of having bad credit extend far beyond the initial loan approval process:

1. Higher Interest Rates

Lenders mitigate the risk of lending to individuals with bad credit by charging higher interest rates. This increases the cost of borrowing, making loans more expensive over their lifetime.

2. Less Favorable Terms

Besides higher rates, loans might come with more stringent terms, such as shorter repayment periods or the requirement for more substantial collateral. These terms can make the loan less manageable for the borrower.

3. Limited Loan Options

Many traditional banks and financial institutions may not offer loans to those with bad credit, limiting the options to alternative lenders who typically charge higher rates.

4. Impact on Business Growth

High rates, stringent terms, and limited options can stifle business growth. Access to capital is important for expansion, purchasing inventory, or covering operational costs. Without it, businesses may struggle to scale or even maintain their operations.

Read more: Component of Business: Key Elements Every Entrepreneur Should Know

Challenges of Obtaining Traditional “Business Loans for Bad Credit”

Stringent Requirements

Traditional banks and financial institutions often have strict criteria for loan approval, which can be a significant barrier for those seeking “business loans for bad credit.”

The Need for Collateral

Many traditional loans require collateral, which can be a hurdle if your business lacks assets to secure the loan.

Alternative Lending Options

Broadening the Horizon

Fortunately, the lending landscape has evolved, offering many alternative lending options for those with bad credit. These alternatives often provide more flexible criteria and faster approval processes.

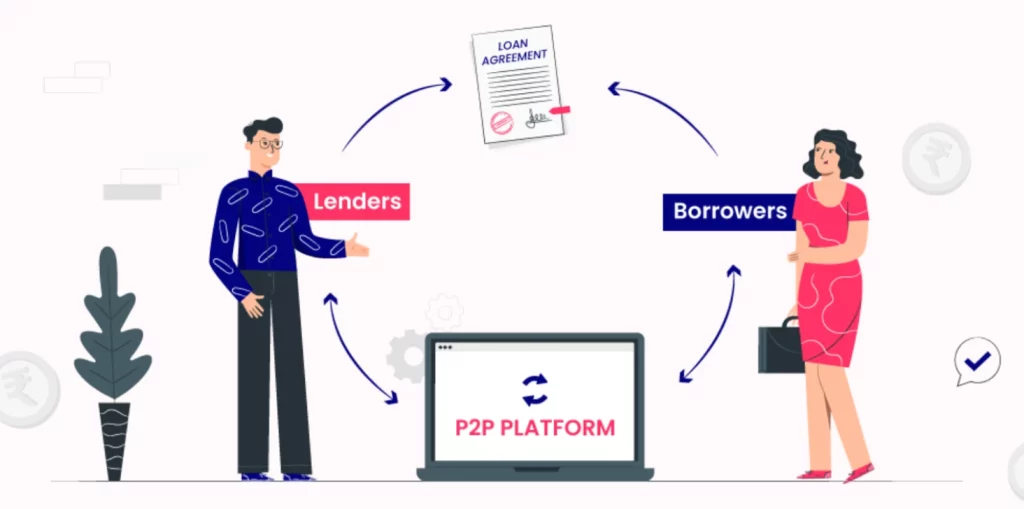

Peer-to-Peer Lending Platforms

Source: LeadSquared

A Community Approach

Peer-to-peer (P2P) lending platforms connect borrowers directly with investors, bypassing traditional banking systems.

This option is viable for those with bad credit, as P2P platforms focus on the overall business potential rather than just the credit score.

Microloans and Community Development Financial Institutions (CDFIs)

Small Loans, Big Impact

Microloans and CDFIs are designed to support underserved entrepreneurs. They offer smaller loan amounts, which can be perfect for businesses looking to make modest investments or cover operational costs.

Strategies for Improving Creditworthiness

- Regular Monitoring: Keep an eye on your credit report to identify and rectify any errors.

- Debt Management: Work on lowering your debt-to-income ratio by paying down existing debts.

- Timely Payments: Ensure all your bills and existing loans are paid on time to improve your credit score gradually.

Navigating the Loan Application Process

- Preparation is Key: Gather all necessary documents and information before applying.

- Honesty: Be transparent about your credit situation. Some lenders may offer solutions tailored to your specific circumstances.

- Shop Around: Don’t settle for the first offer. Compare rates and terms from different lenders to find the best deal.

Improving Your Loan Approval Chances

Here are things that can help increase your chances of approval for a business loans for bad credit:

- Understand Your Credit: Knowing where your credit stands is the first step. Aim to rectify any inaccuracies on your credit report.

- Annual Revenue and Time in Business: These factors can significantly impact your loan approval chances. Lenders favor businesses with a steady income and those that have been around longer.

- Offer a Down Payment or Collateral: Providing a larger down payment or collateral can make lenders more inclined to approve your loan, as it lowers their risk.

- Craft a Strong Business Plan: A well-thought-out plan showing how you’ll use the loan and repay it can sway lenders in your favor.

Comparative Analysis of Interest Rates and Terms

It’s crucial to compare the interest rates and terms offered by both traditional and alternative lenders. Alternative lending options might come with higher interest rates but offer more flexible terms that are better suited for businesses with bad credit.

Traditional Lenders (Banks and Credit Unions)

- Interest Rates: Often lower, can range from about 3% to 10% for those with good credit. However, for bad credit, if approved, rates can be significantly higher.

- Terms: Longer repayment terms, usually from 1 to 25 years, provide borrowers with more extended periods to pay back the loan.

- Approval Requirements: Typically, these lenders have stringent credit score requirements, making it difficult for business owners with bad credit to qualify.

Alternative Lenders (Online Lenders, P2P Lending)

- Interest Rates: Higher, reflecting the increased risk of lending to individuals with lower credit scores. Rates can vary widely, starting from about 7% and going up to over 30% or more for those with poor credit.

- Terms: Shorter repayment terms, which can range from a few months to a few years, leading to higher monthly payments but a faster pay-off.

- Approval Requirements: More lenient than traditional banks, often focusing on the business’s revenue and potential rather than just the credit score. This flexibility increases the likelihood of approval for those with bad credit.

Case Studies: Success Stories Through Peer-to-Peer Lending Platforms

Background: A tech start-up in Silicon Valley focusing on green technology solutions with innovative ideas but a lack of credit history and tangible assets.

Challenge: Required $50,000 to finish the prototype of their product for market testing but found it impossible to secure a loan through traditional means.

Solution: Opted for a P2P lending platform specializing in tech start-ups, highlighting their potential market impact and long-term profitability.

Outcome: Raised the necessary funds from investors attracted to the start-up’s potential for high returns, albeit at a higher interest rate of 15%. The funding enabled them to complete their prototype and begin market testing.

Securing a business loan with bad credit is undoubtedly challenging but not impossible. By exploring alternative lending options, improving your creditworthiness, and carefully navigating the loan application process, you can increase your chances of approval.

Remember, every step you take towards securing financing, even with bad credit, expands your business horizons. Get your loan and expand the world with Hi-Fella.