Table of Contents

In a world dominated by global economic interconnections, the United States stands as one of the most influential players. With a multitude of trading partners across the globe, the significance of these economic alliances cannot be understated. This article delves into the United States’ largest trading partner, Mexico, to provide comprehensive insights into the economic powerhouse driving U.S. trade.

We will explore the data that showcases Mexico’s pivotal position in U.S. trade relationships, analyze trade volume statistics, delve into the key industries and sectors involved, and shed light on the historical context and evolution of this vital partnership.

The Largest Trading Partner of the United States

Mexico’s Stature in U.S. Trade Relationships

As of 2023, Mexico holds the esteemed position of being the largest trading partner of the United States, solidifying its significance in shaping the nation’s economic landscape. This partnership goes beyond mere numbers; it reflects a long-standing alliance that has evolved over time.

Trade Volume Statistics

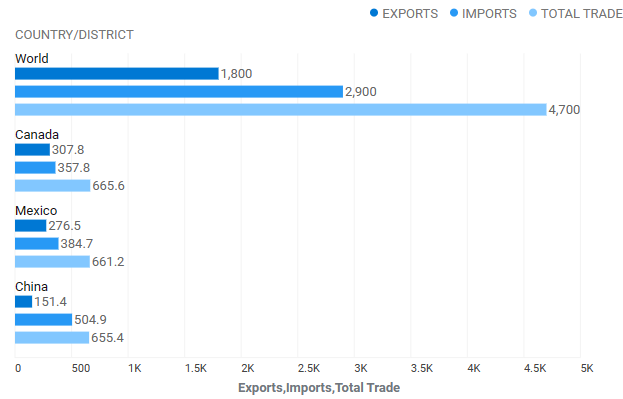

The scale of economic activity between the United States and Mexico is staggering. In the first four months of 2023 alone, the bilateral trade between the two countries amounted to a substantial $263 billion. These figures underscore the immense volume of goods and services exchanged and highlight Mexico’s crucial role in U.S. trade dynamics.

Key Industries and Sectors

Diverse Economic Engagement

Mexico and the United States are deeply entwined in various industries and sectors. From automotive to agriculture, their economic cooperation extends to a wide array of domains. Understanding these sectors is pivotal in comprehending the intricacies of this trading partnership.

The Automotive Sector: A Prime Example

The automotive industry is one such sector that exemplifies the profound nature of this trade relationship. With complex supply chains and production processes that span both countries, the automotive sector showcases the extent to which Mexico and the United States rely on each other for mutual growth and prosperity.

The Evolution of the Trading Partnership

Historical Context and Significance

To fully grasp the current dynamics, we must journey back in time to explore the historical context of this trading partnership. It’s a tale of evolution, marked by significant trade agreements, policy changes, and historical events that have shaped the economic ties between the United States and Mexico.

The Influence of Trade Agreements

The evolution of international trade agreements has been a complex process. Since the inception of the General Agreement on Tariffs and Trade (GATT), the world has witnessed a dual trend in trade agreements.

Multilateral agreements involving multiple nations have flourished alongside local, regional trade arrangements. This complexity mirrors the intricate relationship between the United States and Mexico, which has had its share of trade agreements and negotiations.

The Legacy of Mercantilism

Centuries ago, the doctrine of mercantilism dominated trade policies, with the goal of obtaining a “favorable” balance of trade. Mercantilist policies favored local industry through the use of tariffs, quotas on imports, and the restriction of tools, capital equipment, and skilled labor exports.

These policies discouraged international trade agreements, emphasizing protectionism. Understanding this historical context sheds light on the evolution of trade dynamics between nations.

The Path Forward

As the trading relationship between the United States and Mexico continues to evolve, it is essential for business professionals, economists, policymakers, researchers, and anyone interested in global trade dynamics to stay informed. This partnership is not merely a collaboration; it’s an intricate dance of economics, politics, and history, making it a subject of endless fascination and study.

The Path Forward

In conclusion, Mexico’s status as the United States’ largest trading partner is a testament to the intertwined destinies of these two nations. Their trade volumes, economic engagement, and historical context are all essential elements that contribute to a relationship of paramount significance on the global stage. Understanding this partnership is not just a matter of economic curiosity but a necessity for anyone interested in the ever-evolving world of international trade.

Begin your trade journey with Hi-Fella today, and unlock the potential of the U.S.-Mexico economic alliance! Explore the boundless opportunities that await in this dynamic and ever-evolving partnership.